You cannot open a newspaper at the moment without the latest merger and acquisition (M&A) processes or predictions jumping out. With the very public tussle over the Pfizer takeover bid for British pharmaceutical firm AstraZeneca hitting the headlines daily, it has bought the issue to the fore even more.

With the economy improving and greater stability, more M&A activity will take place as businesses feel increasingly confident to make bold moves again. In fact research from Thomson Reuters has found that global M&A activity is up by 54 per cent in the first quarter of this year, compared to the same period in 2013, with deals totalling $710 billion.

Acquisitions can be the quickest route companies have to new markets and capabilities, and it remains an attractive growth strategy to many. It’s a great time to be a shareholder of such companies too, particularly when considering that the Dixons and Carphone Warehouse merger was worth £3.8 billion. But whilst the financials and potential job loss fallouts are often the most discussed element of an M&A, the reality of a merger – such as how to combine cultures and clients – is rarely discussed.

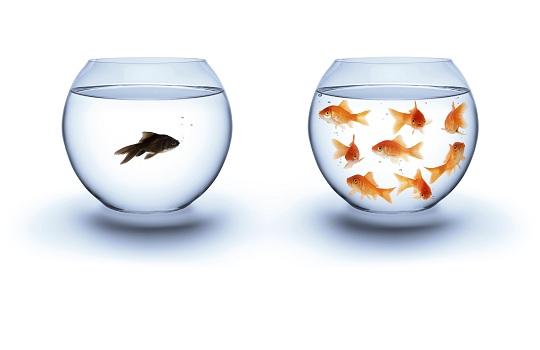

The fallout of neglecting to recognise the importance of culture however is substantial; the abortive merger of two of the world’s largest marketing services groups – Publicis and Omnicom – proves just this. The merger, which would have created the world’s largest advertising group with billings in excess of £14 billion, collapsed after nine months of talks and $60 million of fees. The CEO of Omnicom, John Wren, said that the two groups had “not anticipated the extent of the cultural and management differences”.

Whilst this is an expensive oversight, it is regrettably not an unusual one. In some ways, Publicis and Omnicom may have got off lightly (if shareholders can get their heads around $60 million, as easily) as at least this was aborted before completion.

According to Harvard Business Review, companies spend more than $2 trillion on acquisitions every year. Yet many studies find that the failure rate of mergers and acquisitions are somewhere between 70% and 90%[1]. Failure to return the anticipated increase in shareholder value is commonly put down to cultural misalignment, but it begs the question whether the proper due diligence is conducted in this area.

Ahead of a merger and acquisition financial due diligence reports are weighty; no stone is left unturned with details of anticipated ROI, PE ratios, provisions, leveraged structures, financial synergies (for which read cost savings), debt to equity ratios and balance sheet engineering (again, read cost savings). The accountants are very thorough and the proposed deal looks watertight financially – the hard metrics are well covered. But try and find reference to values, behaviours, engagement and cultural fit. Where work in this area is done at all, it is often superficial or in the spirit of paying lip service.

According to Hay Group only 28% of companies do any objective assessment of cultural fit in an M&A transaction. Cultural due diligence is simply not on the agenda – perhaps because it is seen as the ‘soft side’. But with clear costs associated with getting it wrong, what can be done? For a start, those conducting due diligence reports should involve the ‘people people’ in a business – human resource professionals, organisational development specialists and talent experts – and find out about company values, behaviours and what drives employees.

Talking to clients about what makes the company different, and what it is within the culture that makes them buy their services, provides good insight into how maintain business too. Doing this alongside analysis of employee engagement data, finding out what employees value in their company, is also key to understanding what practices should be kept and what should be reviewed in a merger.

By looking at the ‘people’ elements, all parties concerned will have a stronger vantage point as to understanding whether their cultures are likely to merge effectively. Once a merger has taken place as well, professionals can have a head start as to whether a refreshed, or combined, value proposition needs to be conducted to reflect the changes. Continuing business as usual, when so much has changed, may result in top acquired or existing talent moving on – with their desirable clients too.

The people agenda is often driven from the top as well, so it’s important to understand how the senior team hire and reward, and understand what it is that gets individuals noticed by them. It is then a simpler process to see how a merged business and senior leadership team might work together in the future – by ensuring that skills and values are appropriately aligned to get the best out of the situation.

Conducting a cultural audit in the first instance could help alleviate issues that may arise both pre- and post-merger – saving time, money, heartache and reputational embarrassment. What leading management guru Peter Drucker said in the 1950s still applies today too: “Culture eats strategy for breakfast”. If only culture played a larger role in merger decisions, businesses could find themselves in much stronger positions.

[1] "Leading Successful Change: 8 Keys to Making Change Work", by Gregory P. Shea, PhD, and Cassie A. Solomon

One Response

Merger of Cultures: The costs of getting it wrong

Hi Gary. A very insightful feature and I couldn't agree more with your conclusions. I was fortunate enough to be involved with one of the 28% who do take culture seriously. A large multinational was buying a smaller high-tech company in Los Angeles and I was asked to conduct an in-depth audit of the senior team. Using psychometrics and structured interviews I was able to report on the strengths and weaknesses of individual Directors and the team as well as the culture of the team and management in the firm. In broad terms the company culture was much more informal and the key players more 'maverick' compared to the multinational. The due diligence process was already making them feel uncomfortable and if any of them had walked the value would have dropped significantly. The buyer did listen and radically changed its approach to the whole acquisition process and subsequent dealings with the company – pulling out their financial analysts, allowing greater autonomy and providing more arms length support.