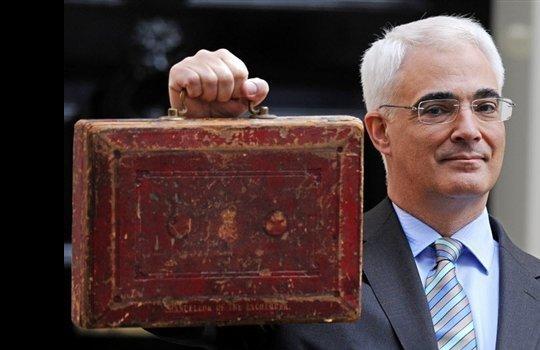

A pre-budget report before an election might usually be a giveaway but with huge public borrowing and a gloomy economy, Alistair Darling's good news was severely curtailed.

This year's pre budget report was bound to be a balancing act: with a serious economic situation and an election just around the corner, the delicate balance became a high wire act. Taking a look anywhere around the net it's obvious that bankers being singled out for punishment by taxation is a populist idea: the Liberal Democrats, among others, have been quick to point out that separating high earners from bankers is a misconception and that those earning those sums are likely to be able to avoid such taxes – with some claiming evidence that some bonus earners have already received them in anticipation of this very tax rise.

Including the value of the employer pension contributions as income is one way the government is seeking to crack down on tax avoidance. Naturally, this leads to concerns there may be issues with retention for many financial institutions. Sean Drury, international mobility partner, PricewaterhouseCoopers LLP (PwC), said: “In terms of the impact on the financial services sector, it’s unlikely a one-off levy on bonus pools in isolation would cause employers or employees to decide to relocate outside of the UK. But in combination with the incoming 50% income tax rate, National Insurance Contributions increases, restrictions on pensions tax relief and changes to the taxation of foreign nationals, the tax on bonuses will contribute to the declining attractiveness of the UK as a business location.”

The possibility of taxing employer pension contributions complicates matters further, as Carol Dempsey, reward partner at PricewaterhouseCoopers, explained: "This adds yet more complexity – particularly around assessing how much an employer's contribution is to a final salary scheme. This could be inequitable as this is not income that the individual can access and yet will drive an exposure to an immediate tax bill."

Sarah Pickering, Managing Director of Alvarez & Marsal Taxand LLP agreed, saying: “High rate tax payers are being heavily penalised. Most are giving away more than they get to keep, which is hardly a motivation to be successful.”

Roger Breeden, principal at Mercer, added: “This makes long-term decisions and personal financial planning much more complicated for employees and employers. People may be driven away from retirement planning by the increasing complexity and distrust of the system."

However for the unemployed under 24s there was better news: the ‘job or training guarantee’ will now kick in for young people at six months. Gerwyn Davies, Public Policy Adviser at the Chartered Institute of Personnel and Development (CIPD) said: “Modest increases in unemployment in recent months mask the growing challenges faced by jobseekers, particularly if they are young and have been unemployed for more than six months.”

Young people are not the only one struggling in the employment market. Davies added: “The challenges facing older workers are set to worsen in the coming months. We urge the Chancellor to urgently consider extending the jobs guarantee to ensure over 50s who have been unemployed for more than six months are given the real help they need to get back into work.”

Meanwhile, national insurance contributions will go up by 1% for employees and employers alike: Charles Cotton, Reward Adviser at the CIPD, said: “The Chancellor would have done better to use any increase in employee NICs to scrap the planned increase in employers’ NICs from 2011. This tax on jobs will hit at a time when we are still likely to be in the early stages of a ‘jobs light’ economic recovery – this is not the tonic a sickly labour market needs.”

Additionally, public sector salaries rises have been capped at 1%. Cotton added: “We would have preferred a 1% cap on the public sector pay budget as a whole, to better allow managers to increase pay rates for key jobs where there are shortages and for those who are high performers, while freezing them where there is no market reason.”

He concluded: “What is needed is a more fundamental review of what is sustainable in public sector pensions, to ensure the cost and risk is more equitably shared between taxpayers and tax-funded workers.”