The Financial Services and Manufacturing industries have the weakest leaders in the UK, according to a detailed study released this morning by Head Heart + Brain, a leadership development consultancy.

To gauge the standard of leadership in different industries, Head Heart + Brain commissioned a poll of more than 2,000 people which asked UK workers questions about their bosses based on the key criteria of what makes a good leader. These criteria are derived from the principles of neuroscience, which shape how effectively people lead in the workplace. The index measured various factors – from the amount of autonomy employees are given and the clarity and openness of communication about job responsibilities and targets to the quality of feedback and the fairness of leadership. But by far the most important factor the index analysed was how well leaders help employees understand change – and their part in making it successful.

When Head Heart + Brain asked employees in organisations where some difficult change had occurred over the last six months, “How much does your leader help you understand the change and your role in making it successful?” leaders in the Financial Services sector came out at the bottom of the list – just 11% of employees said their leaders had made a big effort to help them understand the change and their role in making it successful.

Jan Hills, partner at Head Heart + Brain, explains: “The best bosses lead their staff in a ‘brain-savvy’ way, in a manner closely aligned with the way that people’s brains are wired to respond best to leadership. Neuroscience tells us leaders must follow several golden rules if they are to get the best out of their staff. Crucially, they must help employees understand why organisational change is good for them. Fortunately, this research highlights that there are lots of brain-savvy leaders in the UK’s Telecoms sector. But it also reveals leaders in finance, insurance and accountancy – as well as manufacturing – are managing their employees badly. That has massive implications for the country – first-class leadership in these sectors is essential if we are to return to the wider economy to full growth. It’s good news for the future of Virgin Mobile, Vodafone, and Inmarsat – but it’s bad news for the banks, the insurance sector and the UK’s accountants.”

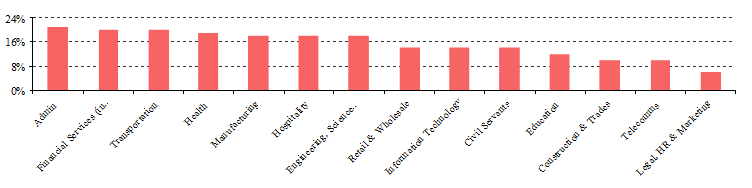

The Brain Savvy Index

The findings may go some way to explaining the level of pressure that workers in the UK’s banks, insurance companies and accountancy firms are exposed to – the study revealed 40% of Financial Services employees thought the leaders in their organisation had put them under a lot of pressure in the past six months, compared to the UK average of just 22%. This was the highest level of any industry in the UK. In contrast, those working in Telecoms reported the fewest number of people under a lot of pressure in the last few months (14%).

The leaders of my organisation have put me under a lot of pressure in the past 6 months

The poor overall level of brain-savvy leadership in the UK also appears to be having a negative effect on employee engagement – a key factor in creating a high performing workforce. Less than one third (32%) of employees are fully engaged with their job and over one in seven UK workers (14%) say they aren’t engaged with their organisation at all. In contrast, only 10% of people working in Telecoms say they aren’t fully engaged with their organisation – half the number in Financial Services (20%).

I do not feel engaged with my job

Cause of Sector Variations

The research demonstrated a correlation between sectors with low levels of brain-savvy leadership and sectors where employees say their leaders are under a lot of pressure.

Jan Hills says, “It’s clear that the credit crunch and the resulting recession, far from bringing out the best in our leaders – brought out the worst in them. Two of the sectors that were hardest hit were Financial Services and Manufacturing. In contrast, the UK’s Telecoms industry is flying high – Inmarsatt’s full year results for 2012 showed a solid return to growth for their core mobile satellite services business. And Vodafone reported more profit before tax in 2012 than it had done since 2004. Its latest takeover will help make it a feasible competitor to the biggest worldwide comms companies like Liberty Global.”

Impact on the Economy

The low overall quality of leadership is contributing to the low levels of productivity in the workforce. Output per worker per hour in the UK is 19 percentage points lower than the average among G7 countries, and 2 percentage points lower than it was in 2007.[i]

Jan Hills explains: “The UK’s economic output is lower than in other G7 countries partly because of bad leadership. Our research shows leaders are failing on a number of key brain-savvy criteria that defines a good boss – particularly in areas like helping employees understand change and ensuring they have clear goals. This ‘brain-fried’ style of leadership makes the whole workforce less productive. If they want to succeed in the post-recession economy, and want to create a high performing workforce, leaders need to start leading in a way that is more compatible with how the brain functions.”

UK Leaders Failing To Implement Change Successfully

The most worrying aspect of this poor overall level of leadership is the failure to successfully implement organisational change. Neuroscience research shows the key to successfully changing an organisation is for leaders to help their employees understand why the change is happening and why it is good for them personally. This is a huge problem; 70% of UK employees say they have experienced difficult change at work over the last six months – but 15% of those employees say their leaders have not helped them understand change or their role in making that change a success.

Some sectors have been hit harder than others. In Financial Services, 86% of employees have experienced organisational change – with 22% of bosses failing to help them understand it. But the worst hit sector is Health where 78% of workers say they have experienced difficult organisational change – but almost a quarter of leaders (24%) have failed to help employees understand their role in making the change a success or why that change is good for them.

Jan Hills explains: “The economy always has to recalibrate after a recession. For it to recover, people and capital have to move away from declining sectors towards more productive ones. And for that to happen organisations need to go through periods of change. But many of those organisations are failing to carry out that change successfully because they are being led poorly. Leaders aren’t communicating why change needs to happen, and they are not helping employees realise why it is good for them – which is the key to implementing change successfully. Telling staff to change is counter-productive. It creates feelings of threat and resistance to the changes. This failure to deal with change is a major reason why productivity is still so low in comparison to the relatively good health of the jobs market.”

Failure to set clear goals and provide certainty

Financial Services bosses are also the poorest at setting clear targets. When asked “How clear are you about your role at work and the targets you need to achieve this year?” 40% of employees in the Financial Services industry said their targets weren’t very clear. Telecoms leaders – who are among the best leaders in the UK – are the best at providing clear targets and a sense of certainty. Almost three quarters (72%) of employees in the sector have a clear understanding of their role and purpose, significantly above the UK average of 60%.

Jan Hills says: “Brain-savvy leaders work hard to communicate a clear purpose for the team, and help each team member understand what this means for them and their role. If people understand what they are doing, it creates a sense of certainty that makes them feel less threatened and more willing to accept change.”

Failure to maximise feelings of reward through praise and recognition

And UK leaders are failing to maximise feelings of reward in the workforce. When asked whether their leader gave them praise, positive feedback or recognition of their contribution to the organisation, just 17% of employees said the feedback they got was always constructive. 42% said feedback was only ever negative, or that there was none at all.

Financial Services bosses are amongst the poorest in the UK at this aspect of leadership, too. 45% of employees in the sector receive only negative feedback (or none at all) although leaders in Education and Manufacturing are worse still (48% and 51% respectively). Leaders in Engineering, Aerospace & Science are the best at giving praise and recognition. 22% of employees in this sector receive feedback and praise that is only ever positive, the highest of any sector in the UK.

Jan Hills comments: “Rewards should be based on brain-savvy principles. Financial reward is important, but it’s not everything. Social-based recognition and praise for good work are just as important for stimulating feelings of reward in the brain. Currently, few leaders are creating feelings of reward – they’re making their employees feel threatened instead. When employees feel threatened, their decision-making is adversely impacted. It creates limitations on people’s ability to perform and, in severe cases, increases the risk of employees suffering from depression and anxiety.

‘BRAIN-SAVVY INDEX’ METHODOLOGY

The Index was constructed using the results of a poll of 2,000 UK workers. Employees were asked questions about their leaders, based on criteria derived from neuroscience. These criteria form the basis of good leadership – what Head Heart + Brain call ‘brain-savvy’ leadership. The criteria used were:

- The ability of leaders to help employees understand why change is good for them personally and the employee’s role in making it successful

- How far leaders give employees autonomy, and different options on how to carry out their work

- The ability of leaders to set clear goals

- How open communication is between employees and their leaders

- The ability of leaders to give positive feedback, recognise an employees’ contribution, and enhance the reputation of their staff in the eyes of the wider organisation

- How fair leaders in an organisation are fair when dealing with employees

[i] ONS, International Comparisons of Productivity (September 2013)

3 Responses

Retail challenges

Jamie is right the thing that pulls retail down is managing change. particularly helping employees understand why chnage is good for them personally. 72% said there had been difficult change and 87% said their leaders had either not helped them understand the change or only a little. Brain-savvy leaders are much better at change than brain-fried leaders.

in addition 71% said they were only a little or only some what engaged. this is probably linked to the change issue.

The other thing to note with in our data is 70% of people who answered the survey had been in their job for 3 years of more. so we seem to be getting employees who are quite stable responding.

where retail do quite well is on open communication 40% positive

Hope this helps. Thanks for your question Lynda.

Retail industry

Hi Lynda –

Thanks for the comment. This is the first study published by Head Heart + Brain. The founder, Jan Hills, writes a lot of content for us on neuroscience-related topics – you can find a summary of it all here: https://www.hrzone.com/feature/people/evidence-based-hr-neuroscience-business-and-hr-department/140818.

Retail – it's interesting, and I think there could be a variety of reasons. Firstly, a lot of workers in retail are transient. To accurately judge and emotionally respond to a leader I think you need to envisage a future with them and I think a lot of retail workers are simply not engaged enough (due to short-termism) to do so.

The retail market is also in a pretty grim state which again impacts upon the ability of leaders to lead well, particularly if purse strings are tightened and there's no money to be spent on ensuring leadership is doing its job effectively. Pressure from online retailers is making this worse.

Retail also seems to be behind the trends in terms of innovative/brain-savvy styles of leadership/working – they are one of the most siloed organisation-types, working within traditional structures, although there are some retailers innovating in HR e.g. Zappos. For example, appraisals and performance management in the retail sector is likely to be dominated by traditional processes which do not inspire trust in leadership.

Finally, the retail sector has always struggled with change – I imagine a lot of the workers in the retail sector, who are digitally-savvy and understand the market, are frustrated by the slow-moving pace of change, and this doesn't help them trust and respect senior leaders.

Jan, you can probably provide more insight on this than me, do you have any comment?

Retails

Jamie,

Interesting articele. How often is is this index reported?

The scores on retail look quite poor. o ou ahve any particle comment on that?